If you are a business owner and your lender is requesting a CPA letter for a mortgage, you’re in the right place.

For self-employed, business owners, or partners needing independent verification of income or business assets for a mortgage lender.

$1,500

If you are self-employed and have met with bankers, landlords, mortgage brokers, or lenders to discuss renting or mortgaging a home, they may have asked you for a CPA letter to verify or estimate your income. Learn about CPA letters and what CPA letter services can do for you.

A CPA letter is a document issued by a certified public accountant (CPA) that confirms a borrower’s financial health or verifies specific facts about their financial situation, to meet specific terms and agreements.

These letters are sometimes called comfort letters because they are designed to provide comfort to the other party by serving as a trusted third party’s assurance of the applicant’s financial capabilities. For example, an accountant can issue a CPA letter for income verification to a landlord to affirm a prospective tenant’s ability to pay rent.

A CPA letter is a specific type of comfort letter where the trusted third party is an accountant or accounting firm. Other entities that can release comfort letters include banks, private companies, underwriters, and governments.

An accountant or accounting firm can provide different comfort letter types as part of their CPA letter services, each with a specific purpose and intended recipient. Below is a list of the most common types.

A CPA letter for a mortgage certifies a potential borrower’s financial health to a bank, a money lender, or another creditor when applying for a home loan for a mortgage.

Example: A borrower applies for a $250,000 mortgage loan at Alpha Bank. After confirming the loan’s total value and the number of installments (e.g., monthly over 30 years) plus interest (e.g., 5%), the CPA letter affirms the accountant knows the borrower’s financial situation and confirms they will be able to make the repayments without delay or hardship.

A CPA letter for an apartment or rental property is issued by a potential tenant to the landlord to verify a tenant’s ability to pay rent.

Typically, employers verify a tenant’s income by requesting a letter of employment or an IRS Form W-2. For self-employed individuals, these options are not available; a CPA letter replaces these documents.

In specific instances, landlords may request that the CPA letter be notarized as an additional layer of comfort. Notarization proves the letter’s legal authenticity and protects against fraud.

Example: Mr. Bravo, a self-employed individual, approaches Mrs. Charlie, a landlord, to apply for the rental of an apartment. Upon learning that Mr. Bravo is self-employed, Mrs. Charlie may request a CPA letter certifying Mr. Bravo’s income and financial projections over the next 12 months.

A CPA letter of business existence is a document proving the existence of a self-employed individual’s business. Landlords may request this type of CPA letter from a potential tenant to verify their status as self-employed individuals.

Example: Mrs. Delta is the sole proprietor of Delta Solutions, LLC. According to the IRS, this status makes Mr. Delta a self-employed individual. Upon approaching the landlord to apply as a potential tenant, the landlord requests a CPA letter of business existence. The letter certifies the existence of Delta Solutions, the company’s contact information (e.g., addresses, phone numbers, email, etc.), how long the company has existed, and a certification that Mrs. Delta is the company’s sole proprietor.

A CPA letter for withdrawing business funds is a rarely-issued type of CPA letter. Its purpose is to provide official assurance from an accountant or accounting firm that the usage of business funds will not adversely impact the business or its operation.

Self-employed individuals use this CPA letter type to make down payments on a loan. Accountants rarely issue this CPA letter type, as using business funds for personal purchases carries many liability risks.

For instance, mixing personal expenses with business expenses increases the risk of incorrectly categorizing a business’s expenses. Because business expenses are tax-deductible, making categorization mistakes increases the risk of an IRS audit. You should also check state and local laws to ensure the usage of business funds for personal purposes is legal in your area.

Example: Mr. Echo, a self-employed individual and sole proprietor of a Limited Liability Company (LLC), wishes to fund a down payment for a home mortgage. If he chooses to use his LLC business account to fund it, Mr. Echo may issue a CPA letter for the withdrawal of business funds to the lender or broker. The letter contains assurances from an accountant or accounting firm that the down payment will not negatively affect the LLC’s business operations.

CPA letters for business assets function similarly to CPA letters for business funds. Self-employed individuals may, in some circumstances, use assets from a business they are the sole proprietor of as a source of funds for down payments.

As with CPA letters for withdrawing business funds, the primary purpose of a CPA letter for business assets is to reassure lenders and brokers that using these assets will not cause undue hardship to the business.

Example: Mr. Echo may use one of the business assets instead of the funds from the company’s business account to fund a down payment on a home mortgage. In this instance, the lender or broker may request a CPA letter to ensure that using these assets to make this payment will not adversely impact Mr. Echo’s LLC.

A CPA letter of income verification is a document proving an individual’s sources of income, typically a self-employed person. This document confirms that the accountant or accounting firm has independently verified the individual’s tax returns and can attest that their income comes from self-employment.

Mortgage brokers, landlords, and other entities may request this document from a self-employed client before approving a loan or rental agreement.

Example: Mrs. Foxtrot, a freelancer, wishes to apply for a loan at Alpha Bank. According to the IRS, freelancers are self-employed and have the same status as independent contractors because an employer cannot control the services provided by freelancers. The bank may request a CPA letter of income verification from Mrs. Foxtrot to verify where her income comes from and ensure she has the financial means to pay the loan in full.

A CPA letter to verify self-employment is similar to a CPA letter of business existence but contains specific wording to prove an individual’s self-employment status rather than the existence of a specific business.

Although this CPA letter type is commonly used by self-employed individuals working as freelancers and sole proprietors, it can also prove other types of self-employment status, such as partnerships or gig workers.

CPA letters to verify self-employment should contain information about the applicant’s business (name, address, industry, nature, etc.), how long the applicant has been working for that business, and the applicant’s percentage of ownership of that business.

The letter also affirms that the accountant or accountancy firm has independently checked the applicant’s tax returns.

Example: Instead of requesting a document verifying Mrs. Foxtrot’s income, Alpha Bank may request that she provide a CPA letter to confirm her status as a self-employed individual.

Although each CPA letter is unique, most types should contain specific information to identify the applicant and, if necessary for the CPA letter type, information regarding their business.

The CPA letter’s contents should be on the certified accountant or accounting firm’s letterhead.

A CPA letterhead features the accountant’s name, address, and logo at the top of the page.

The letter should mention the applicant’s full legal name, as listed on their personal records and official documents.

If the applicant is self-employed and their business information is necessary for the CPA letter, it should feature that business’s legal name and, if necessary, the trade name (also called the “doing business as” name or DBA name).

Example: The CPA letter mentions Mr. Smith’s self-employed business, Smith Solutions, LLC, doing business as Smith Solutions.

When the CPA letter describes the nature of an applicant’s business, it must show what type of business it is by explaining what types of products and services it sells, which industry it operates in, its legal structure, and its overall purpose.

Example: Smith Solutions is a limited liability company in the private sector. It is a for-profit company that provides management consulting services to various clients.

The CPA letter should list the exact number of years the applicant has worked for or owned the business or the year in which they started.

Example: Mr. John Doe Smith has been in business as the sole proprietor of Smith Solutions for over 24 years.

Not all self-employed individuals own 100% of their business. If the applicant isn’t the business’s sole proprietor (e.g., business partnership), the CPA letter must list the exact percentage they own.

Example: As the sole proprietor of Smith Solutions, Mr. John Doe Smith owns 100% of the company.

The certified public accountant or accountancy firm issuing the CPA letter must specify how long they have prepared the applicant’s tax returns.

Example: Smith Solutions has employed Tax Shark, Inc., as the company’s trusted tax return preparer since 2018.

The CPA letter must contain an affirmative statement demonstrating that the accountant or accountancy firm has reviewed the applicant’s tax return before filing.

All CPA letters must feature a signature from the certified public accountant in charge, whether independent or working for an accountancy firm.

Example: The accountant’s signature, followed by the words “Certified Public Accountant” and, if applicable, the name of their accountancy firm.

Mortgage lenders always ask for income verification because they need to be certain that you can pay back any loan that is given out. Proof of income may require recent pay stubs and a W-2 form, bank statements, tax returns, and in some cases, a letter from your employer if you recently changed jobs.

Income verification lets the lender know that you can repay your loan on time without issue and provides proof that you obtained the money legally. By verifying your income, lenders confirm that they are dealing with someone making legitimate money. If you plan on using cash received outside of your job for a down payment, make sure to include proof of how you obtained it.

The most common way to get a CPA letter is to contact the CPA that has been preparing tax returns for your business. This person can confirm your income, employment, estimated net worth, and tax return status, giving them the information they need to send the letter.

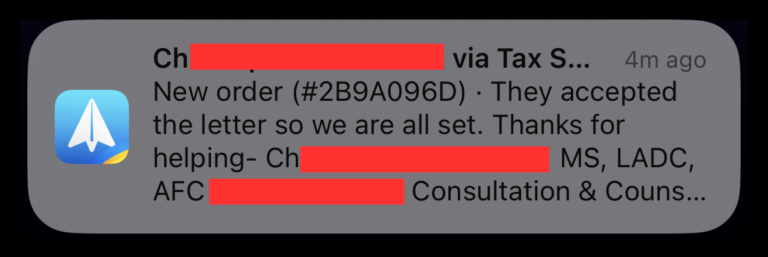

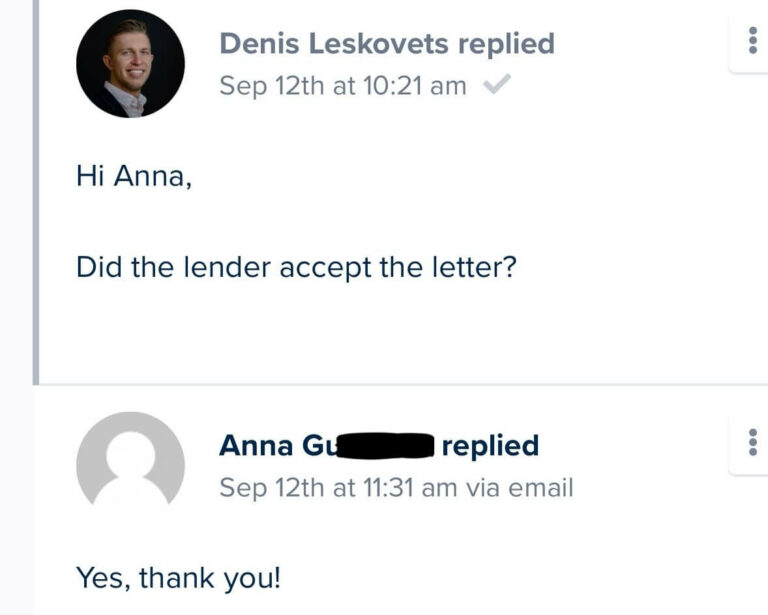

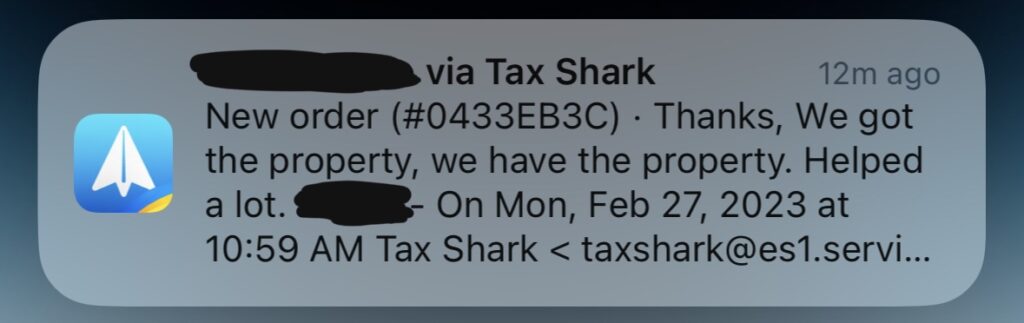

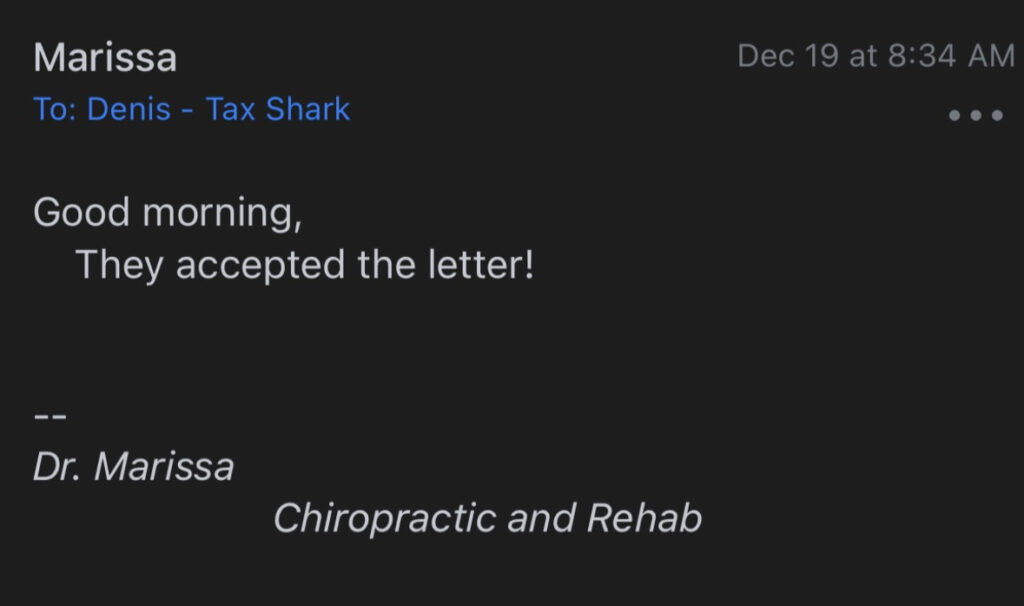

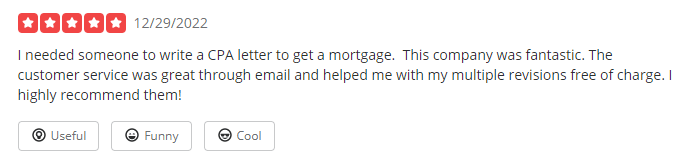

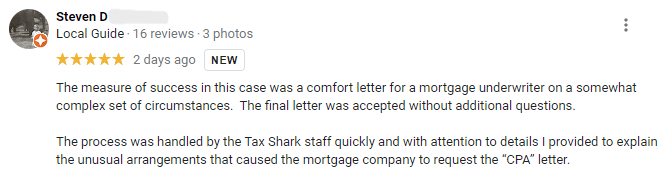

If you do not have a CPA preparing your tax returns, turn to tax experts, such as Tax Shark, who can help certify your income. You can order a CPA letter by viewing the section at the beginning of this page.

As a loan applicant, it is essential to consider what the lender wants. Stable income, good credit score, and a solid debt-to-income ratio. Maintaining all three can be difficult, but having just one outside the preferred range can be a red flag for lenders. This scenario is where CPA letters can be beneficial as they can confirm that the applicant is trustworthy to the lender.

Lenders need to confirm that the applicant has enough income to repay the loan on time and that the income is from a reputable source. By checking credit scores and credit history, the lender can see if the applicant pays back loans on time in the full amount.

Lenders should also check down payments to ensure they are from legal transactions. Make sure to have a record of where the down payment money came from if it’s anything other than savings from income.

Examples would be if the money was a gift. If using gifted funds to make a down payment, the lender will need a signed gift statement with details such as the relationship of the gifter to the buyer as not all loan programs will allow a friend to gift money for down payments.

Letters are a common request for a CPA when someone is applying for a loan. If a CPA is needed, they should confirm the applicant’s financial status before sending the comfort letter.

Sending a letter without proper confirmation will discredit the CPA and lead to a loss of trust. CPAs should also be made aware of any previous attempts to apply for a loan from the applicant. Information on previous loans could conflict with what the CPA finds.

From: [Office Name]

Address

To: [Lender]

Address

Re: Verification of current income

To whom it may concern,

This letter is on behalf of my client [applicant’s name] and confirms that [applicant’s name] has been the owner of [company name] since 2016. He owns 100% of the company. The company is related to IT.

I have been [applicant’s name]’s certified public accountant for the past 6 years. This letter will verify his employment and financial information.

In 2021, [applicant’s name]’s total income was $80,000. Year to date, in 2022, annual income is $30,000, as verified by their financial statements. Total income for 2022 is expected to be comparable to their 2021 income.

If you require any further assistance or information, please feel free to contact me.

Sincerely,

[CPA name]

Certified Public Accountant

The documents needed for a CPA letter include the last 3 years of tax returns, 6 months of bank statements, and business financials (if applicable).

If tax returns are not provided, the taxpayer will need to sign a penalty of perjury addendum for the submitted documentation.

Anyone can write a CPA letter, but to be accepted, it must be prepared and signed by a CPA, Enrolled Agent, or a professional under IRS Circular 230.

Yes, you can write your own CPA letter, but lenders will still need an official document signed by a CPA or Enrolled Agent to approve it.

Yes, it is common for a CPA or Enrolled Agent to be asked to issue comfort letters. In most cases, lenders will ask that a CPA or Enrolled Agent submit the comfort letter on the client’s behalf.

No, a CPA comfort letter is not legally binding. It is sent to promote the idea that the individual or business can fulfill the terms of the agreement.

If a bank is already considering doing business with an individual or a company, a comfort letter helps the bank’s underwriter to better understand certain aspects of the financial data that may have changed, not yet been audited or yet reported.

It depends on your financials. While our team does thoroughly review your financials to verify business income, most individuals are approved for certification and receive a CPA letter.

We accept all major credit cards and debit cards.