The IRS has a variety of automated notices that they send out and many of them are sent after the fact, or for situations you’re already aware of (such as a discrepancy on your tax return you already fixed).

The CP49 notice is one of those “after the fact” notices. Here’s what you need to know about receiving one.

Table of Contents

What is a CP49 Notice from the IRS?

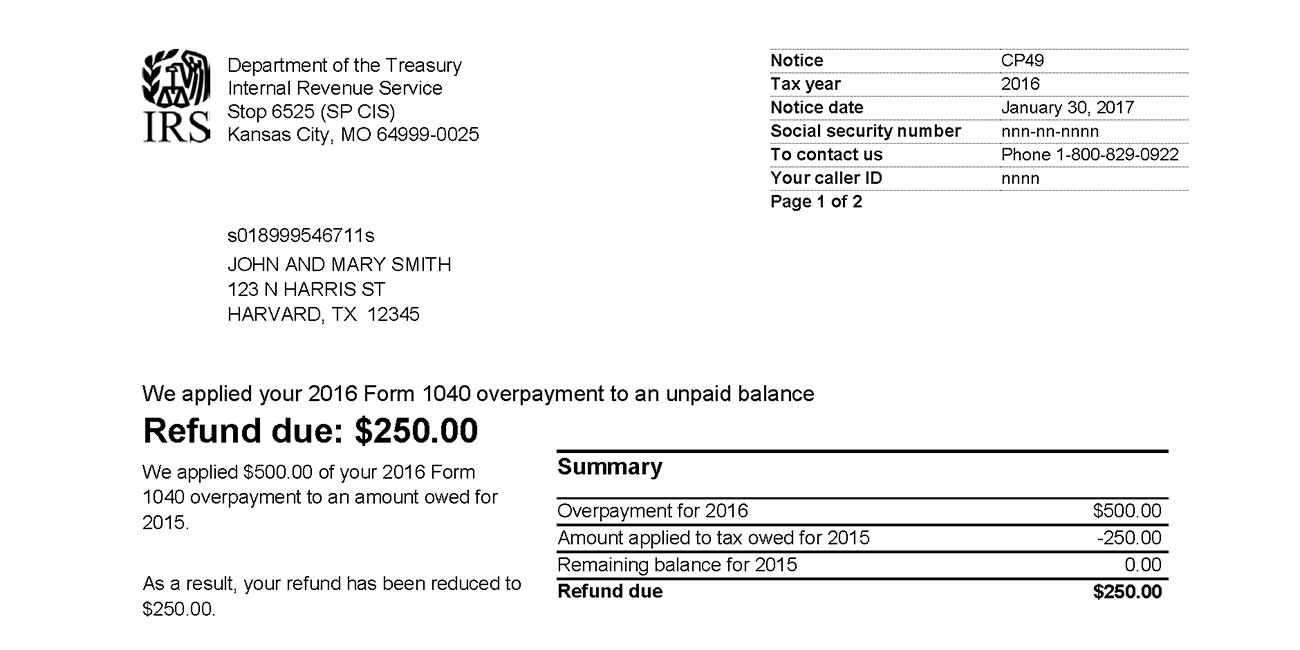

The CP49 notice is one of the automated correspondence series that the IRS uses to communicate with individual taxpayers concerning account status. Receiving one means that you would’ve received a tax refund with your most recent tax return, but the IRS seized it to satisfy your outstanding tax debt.

This notice is usually sent around the time you file your tax return. CP49 is only sent if you owe back taxes that were already assessed but were due to a tax refund on the latest return you filed.

It can come as an unpleasant surprise if you were expecting a tax refund and didn’t receive it. But with over $394 million in individual tax refunds issued in 2019, the IRS is bound to make some mistakes. They also want to make collections as efficient as possible without billing you or taking the time and paperwork to put you on a payment plan, so it’s easier for them to just seize any future tax refunds as they come in.

How Can I Stop an Automatic Tax Refund Seizure?

CP-49 notices are sent after the fact, so you can’t stop the automatic seizure when it happens if you already had a balance due. While you can respond to the notice if you feel they unfairly took your refund, you still can’t stop the initial collection.

If you want to prevent it from happening, you can adjust your tax withholding and/or estimated tax payments so that you don’t receive a tax refund that could be seized. Alternatively, you can pay off your balance due beforehand if you are able to, and aware you owe taxes.

How to Respond to a CP49 Notice

You can contact the IRS by phone or mail if you receive a CP49 notice, noting the following:

I agree with my tax assessment.

If you agree, you might not actually have to respond. However, you should if the IRS only needed part of your refund to satisfy the tax debt and you didn’t get a check for the remainder, you should contact them. The same is true if your refund was seized to pay your spouse’s tax obligations.

I agree with my tax assessment but cannot pay.

If you still owe taxes after your refund was seized, contact Tax Shark regarding tax resolution.

I do not agree with my tax assessment and cannot pay.

You are unlikely to get your tax refund unless there is proof you got this notice by mistake. Contact Tax Shark to review your options.

The CP49 Notice is a Mistake

If you already paid your taxes before filing your return, the IRS may send you this notice in error. You need to contact the IRS right away and show proof of payment and the exact amount you were due.

The CP49 notice is not as complicated as other IRS notices, although it can be a rude awakening if you were expecting a tax refund and didn’t receive it.

We represent taxpayers nationwide for IRS Notices, including IRS notice CP49, IRS notice CP2000, and others.