Final Step - Reach Out Now

Trusted By Clients On

Free, private consultation will give you insight on how you solve tax debt.

Initiate client protection, pull transcripts, review options.

Freedom from tax debt and emotional well-being.

There are few feelings worse than the one you experience when you realize you owe money to the IRS. Being in debt with the IRS makes your life stressful in a way that’s not easily resolved. Tax debt is bad enough for individuals.

It’s even worse when you have a business in Roseville as the IRS can take punitive actions over unpaid tax debt that make it hard for you to operate.

There’s no denying that taxes have to be paid, but it’s difficult when you don’t have the money. Instead of worrying, get tax relief in Roseville from Tax Shark and eliminate your tax debt sooner than later.

The reasons for getting into tax debt with the IRS are varied, but one thing is for certain: When the IRS has determined you owe them money, they do not let you out of the debt. Instead, the IRS punishes you for the unpaid amount through penalties and interest.

This has the effect of increasing your debt and making it harder to resolve. You wind up paying more money to the IRS than you originally owed as well as spending more time paying down the amount you owe.

You can try to negotiate your debt on your own, but you are at a distinct disadvantage in that your knowledge of the tax code won’t be as good as that of the IRS agent. The risks of making things worse for yourself or not getting a settlement that’s in your favor are high.

Instead of trying to negotiate on your own, get tax relief help from experts who know how the IRS operates. Tax relief companies like Tax Shark are well-versed in the operations of the IRS and know how the various IRS repayment programs function.

The IRS has the power to garnish wages and bank accounts through something known as an IRS levy. The agency can do this without first going to court to get legal permission.

If you’ve ignored IRS letters or otherwise failed to negotiate repayment of your debt with the IRS, the agency can levy your financial accounts for repayment.

A levy is not permanent, and tax relief companies like Tax Shark can help you get it lifted, but you should seek tax relief help before you reach the point of an IRS levy.

Tax relief companies can help you get into one of the many tax relief options offered by the IRS.

This option is available for individuals who owe less than $50,000 and businesses that owe less than $25,000. It’s the most popular repayment option for taxpayers who owe, but it does include interest payments. This plan is paid out over a period of years. You apply for a payment plan online and set up repayment once the IRS has accepted your application.

An installment agreement is similar to the online payment agreement, but the balance is paid in a shorter period of time. You can opt for 120 days or longer depending on your ability to repay. This is an area where tax relief help can assist you with making the choice that’s right for you.

In the event you are married and your spouse has incurred debt with the IRS that you have no association with, you can file for innocent or injured spouse relief. The IRS has to determine your liability for the tax debt. If you are found not liable, you can get tax relief and have your refund restored to you.

If you are unable to pay your tax debt, you can get tax relief in Roseville by asking the IRS to delay collection by contacting us and setting up an IRS tax compliance case.

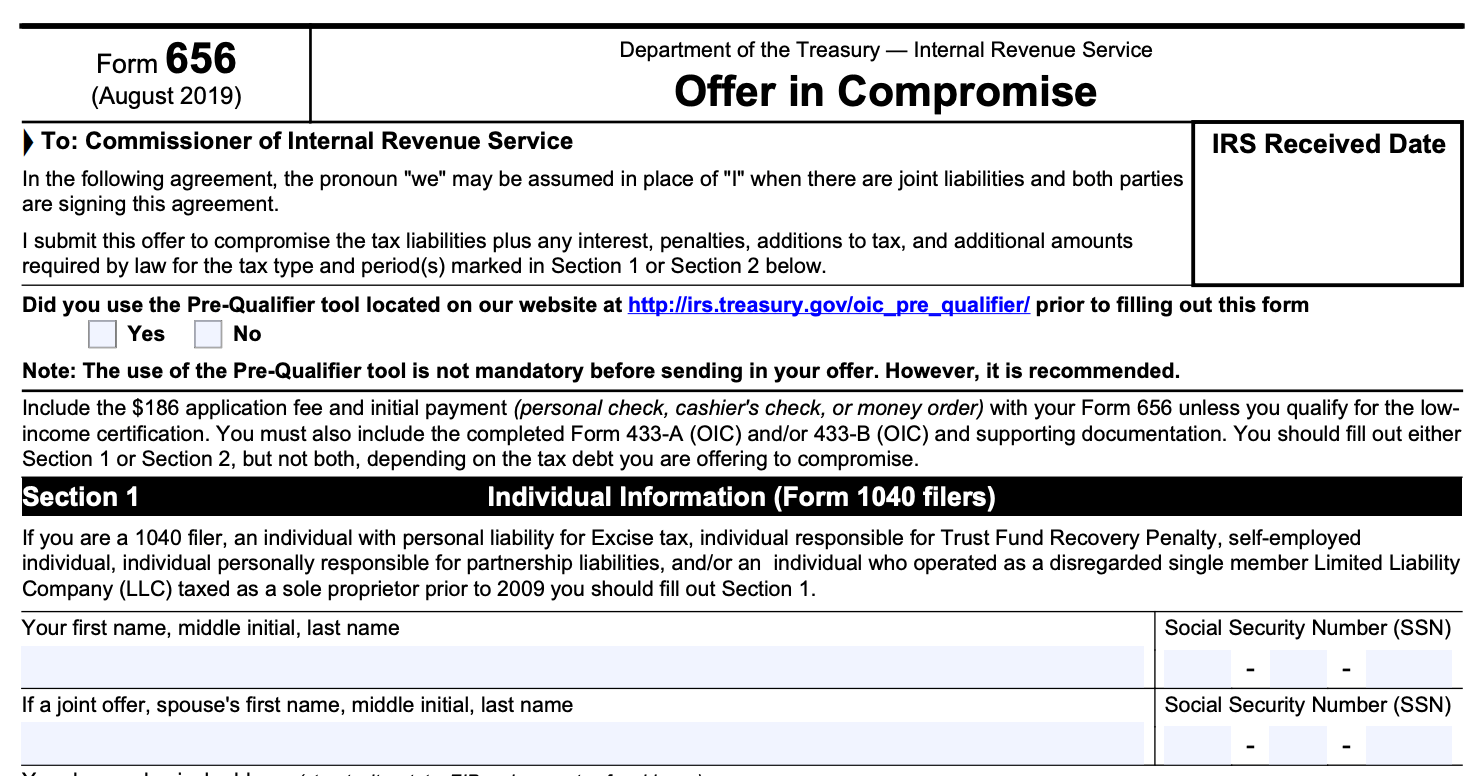

The offer in compromise requires convincing the IRS that you are unable to pay the entire amount of your debt under any circumstances. In turn, you offer to settle your tax debt for less than you owe. This is something tax relief companies can assist you in achieving.

Tax Shark helps individuals and businesses get tax relief in Roseville so they can settle their debt with the IRS and move on with their life. The process of tax relief in Roseville starts with a consultation to determine the extent of the issue and the repayment options that are available to you.

Once you accept the tax relief help, our licensed professional does a thorough review and investigation of your tax returns to look for mistakes that can work in your favor. Afterwards, the licensed professional opens up communication with the IRS in order to start negotiating a reduced tax liability on behalf of the client.

It’s worth noting that the IRS has no obligation to negotiate with delinquent tax payers. It can demand payment in full along with all penalties and interest.

However, the IRS does not seek to create undue hardship for taxpayers as long as there’s communication and good faith in the form of payments. Taking advantage of the help tax relief companies offer is beneficial for you in many ways. The IRS stops sending letters, you retain control of your income and the debt goes away sooner than later.

Lana from Tax Shark was able to answer all of my questions and help me with my situation. She did the research on my issue and got it taken care of. Don't neglect your taxes boys and girls.

Jon E. - Contractor