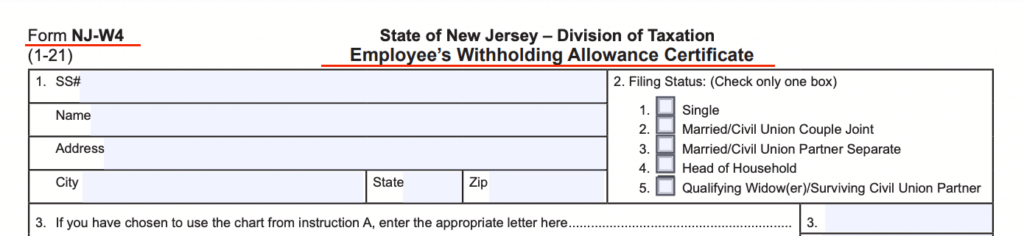

If you live or work in New Jersey, you may be familiar with the state-issued income tax withholding form NJ-W4. It enables your employer to calculate the amount of money to withhold from your pay for state income taxes. Knowing how to complete Form NJ-W4 accurately ensures your employer withholds the correct amount for your tax situation.

What is New Jersey Form NJ-W4?

Form NJ-W4 Employee’s Withholding Allowance Certificate is a New Jersey state tax form issued by the New Jersey Treasury Division of Taxation that allows employees to elect how much tax is withheld from their paycheck. It is required for employees of a company based in New Jersey.

New Jersey Form NJ-W4 can be considered a state-level equivalent of the federal IRS Form W-4, used to calculate federal income tax withholding. If you need information or help filling out your W-4, please read our Form W-4 guide.

What are Allowances on NJ-W4?

NJ Form W-4 allows you to claim a specific number of allowances. It’s crucial to correctly calculate and claim the right number of allowances to avoid overpaying or underpaying your state taxes throughout the year.

The allowances take into account your marital status, filing status, the number of dependents you have and if you have more than one source of income.

Here is how you determine your allowances:

- Personal allowances: This accounts for yourself and, if married, your spouse.

- Dependent allowances: Here, you count the number of dependents you have, such as children or sometimes other relatives living with you whom you support.

- Other allowances: If you have other tax credits or deductions specific to New Jersey’s tax laws, you might claim additional allowances here.

You can find instructions for claiming allowances on the NJ-W4 form on the New Jersey Division of Taxation’s official website.

Do I Need to Fill Out NJ-W4?

If you are an employee working in New Jersey, filling out the NJ-W4, which is the Employee’s Withholding Certificate, is required. The NJ-W4 form dictates the amount of state income tax that will be withheld from your paychecks.

Benefits of Filling Out NJ-W4

Filling out the NJ-W4 form correctly has several benefits:

- Tax accuracy: Helps in ensuring that the correct amount of tax is withheld from your salary, avoiding underpayment or overpayment.

- Financial planning: Allows for better financial planning as you can tailor your withholdings to suit your financial goals and needs.

- Avoid penalties: Helps in avoiding potential penalties that come with underpaying taxes.

How Long Does This Benefit Last?

The benefits last until there is a significant change in your personal or financial circumstances. Typically, it’s good practice to review your NJ-W4:

- Annually: To adjust for any changes in the tax law or your financial situation.

- Life events: After life events such as marriage, divorce, or the birth of a child, to reflect your current status accurately.

How Filling Out NJ-W4 Affects Your Tax Return

- Refund size: The allowances and extra withholdings you claim directly affect the size of your potential tax refund. Claiming fewer allowances can lead to a larger refund (but smaller paychecks) while claiming more allowances can result in a smaller refund (but larger paychecks).

- Tax liability: Adjusting your withholdings can help you avoid a large tax bill at the end of the year.

- Control over finances: Properly filled NJ-W4 gives you better control over your finances, allowing for more predictable budgeting and financial planning.

What if I Don’t Fill Out NJ-W4?

If you fail to fill out a Form NJ-W4 when required, you cannot claim allowances or adjust your withholding status. New Jersey law requires your employer to withhold taxes in accordance with the rules outlined in NJ-WT, Income Tax Withholding Instructions. Without this information in an NJ-W4, they may be unable to accurately calculate your tax withholdings and increase the risk of either over- or under-withholding.

- If you fail to fill out the NJ-W4 form, the employer will withhold state taxes at the highest rate possible, which is as if you are single with no allowances. This might not be suitable for your actual tax situation and can lead to over-withholding.

- Not filling out the NJ-W4 form can potentially delay your tax refunds, as it might raise red flags with New Jersey tax authority, necessitating a tax audit.

- Over-withholding means your employer withholds more money than is necessary to pay your income taxes, resulting in less take-home pay. Failing to submit your NJ-W4 also means your employer cannot reimburse you or settle the difference for over-withholding despite having the right to do so.

- Under-withholding means your employer withholds less money than is necessary to cover your income taxes. When you file your Income Tax return, you may end up owing unpaid taxes when filing your next tax returns. You also risk being exposed to various penalties: A late payment penalty may apply, equal to 5% of the unpaid taxes, plus interest, equal to a prime rate plus 3%, compounded yearly. You can find the latest version of the New Jersey interest rates on Document TB-21(R).

How to Fill Out New Jersey Employee’s Withholding Allowance Certificate

Completing Form NJ-W4, Employee’s Withholding Allowance Certificate allows your employer to withhold the correct amount of money to cover your income taxes. Follow this step-by-step guide to complete your form accurately.

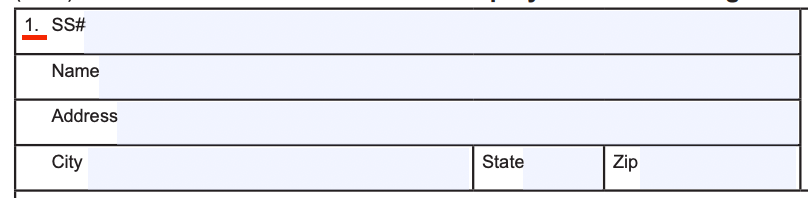

Line 1: Personal Information

You will need to enter the following information under Line 1:

- Your Social Security Number (SSN). Form NJ-W4 uses the SS# abbreviation to refer to your SSN.

- Your full legal name

- Your complete address, including your city, state code abbreviation, and ZIP code.

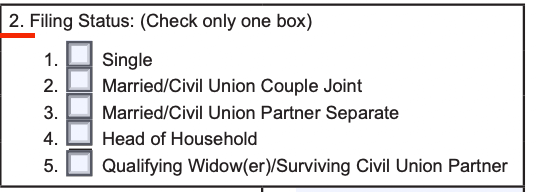

Line 2: Marital Status

Check the box corresponding to your marital status. Check only one box. Your options are:

- Single

- Married or in a civil union, filing jointly

- Married or in a civil union, filing separately

- Head of household

- Qualifying widow, widower, or surviving civil union partner

If you select Box 2, 4, or 5, check if you meet both of the following conditions:

- You and your partner (if applicable) work two or more jobs

- The combined total wages exceed $50,000

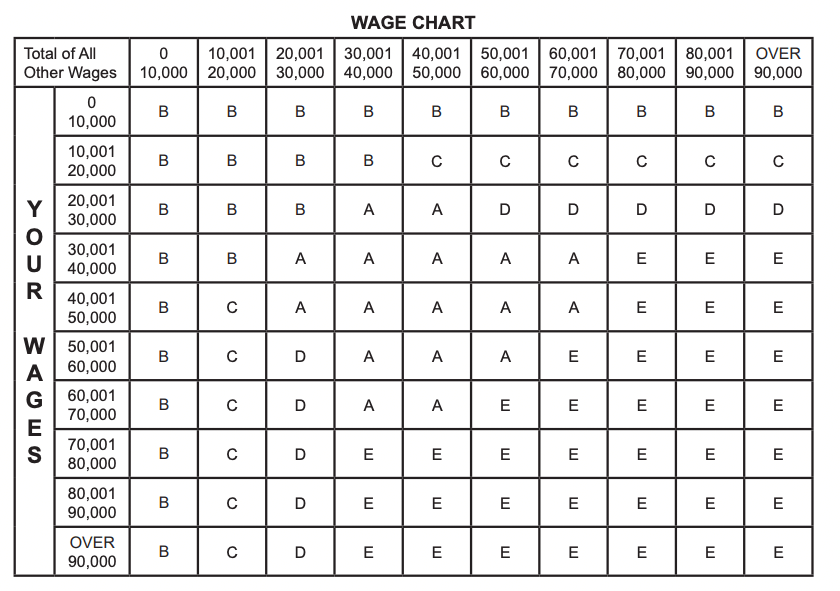

If this applies to you, you must use the Wage Chart under Instruction A to calculate your withholdings, then enter the appropriate letter code on Line 3. If you do not enter a letter code, the state will process the Form as if you entered B.

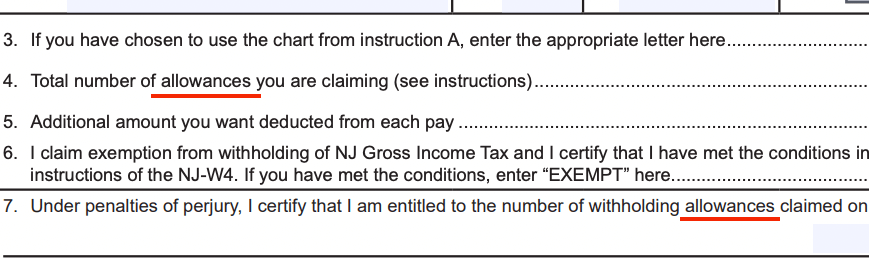

Line 3: Wage Chart Code

If you have chosen to calculate your allowances using the Wage Chart under Instruction A, enter the letter code corresponding to your situation here. Please refer to the “How to Use the NJ-W4 Wage Chart” and “How to Use the NJ-W4 Rate Tables” sections below.

Line 4: Total Allowances Claimed

Enter the number of withholding allowances you wish to claim here. Ensure you do not claim too many withholding allowances to avoid under-withholding.

According to Document NJ-WT, the value of an allowance depends on the payroll period. The possible values are as follows:

Payroll period | Value of one allowance |

Daily or | $2.70 |

Weekly | $19.20 |

Bi-weekly | $38.40 |

Semi-monthly | $41.60 |

Monthly | $83.30 |

Quarterly | $250 |

Semi-annual | $500 |

Annual | $1,000 |

To calculate the number of allowances you can claim, check whether you need to use the Wage Chart.

- I Don’t Need to Use the Wage Chart

You generally don’t need to use the Wage Chart if you checked Box 1 (single) or Box 3 (married/In a civil union and filing separately) under your Filing Status. According to the Form’s basic instructions, your withholding rates are those listed at Rate “A” in the Rate Tables. Refer to the “How to Use the NJ-W4 Rate Tables” section to calculate your withholdings.

- I Need to Use the Wage Chart

Refer to your paychecks and use the Rate Tables for Wage Chart to determine which rates apply to you. Check the “How to Use the NJ-W4 Wage Chart” below for more information.

Line 5: Additional Withholding

Enter a dollar amount corresponding to the amount of money you want withheld from your paycheck at each payroll period. For example, if you enter $125 and are paid monthly, your employer will withhold an additional $125 from your monthly paycheck.

Line 6: Exempt Status

If you are claiming an exemption from New Jersey Gross Income Tax and meet the conditions outlined in the instructions, enter the word EXEMPT on this line.

You may qualify for an exemption if:

- You are single or married/in a civil union and filing separately, AND your wages plus taxable non-wages for the current year will be $10,000 or less.

- You are married/in a civil union and filing jointly, AND the combination of your wages, your partner’s wages, and both your taxable non-wages for the current year will be $20,000 or less.

- You are a head of household or a qualifying widow/widower/surviving civil union partner, AND your wages plus taxable non-wages for the current year will be $20,000 or less.

If you qualify for an exemption, it is only valid for the current year. You must fill out and re-submit a new form each year.

Line 7: Sign and Date

Sign the form under Employee’s Signature and write the completion date under Date.

How to Use the NJ-W4 Wage Chart

The NJ-W4 Wage Chart is a table provided under Instruction A. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works two jobs or more.

The form’s instructions recommend using the Wage Chart if:

- You checked Box 2, 4, or 5 in your Filing Status.

- Your taxable income is over $50,000, whether due to working multiple jobs, you and your partner each working at least one job or a combination of both.

The Wage Chart is not intended for taxpayers who checked Filing Status Box 1 (single) or Box 3 (married/In a civil union and filing separately).

Follow these steps to use the chart:

- Find the row corresponding to your wages. If you work multiple jobs, add them together.

- Find the column corresponding to wages other than your own, such as your partner’s.

- Find the cell corresponding to the intersection of your row and column.

- Write the letter code in that cell on Line 3 of Form NJ-W4.

If your income situation changes significantly, you may need to enter a different letter code. Review your financial situation and your NJ-W4 Wage Chart periodically to determine whether you need to re-submit the Form.

How to Use the NJ-W4 Rate Tables

The NJ-W4 Rate Tables allow you to calculate your allowances according to your filing status and, if applicable, your financial situation.

- If you checked Filing Status Box 1 (single) or Box 3 (married/In a civil union and filing separately), use Rate A.

- If you checked Filing Status Box 2 (married/in a civil union and filing jointly), 4 (head of household), or 5 (qualifying widow, widower, or surviving civil union partner), use the Rate corresponding to the letter code you calculated with the Wage Chart.

The Rate Tables on Form NJ-W4 offer tables to calculate your withholdings based on two payroll periods for each Rate; weekly and annually. If your payroll period is not listed on the Form, refer to the New Jersey Withholding Tables, which feature a complete list of Rates and payroll periods.

Example: Single, Paid Weekly (Rate A)

Amy resides in Camden, NJ. She is single and receives a weekly taxable wage of $600. Here are the steps she must follow to calculate her withholdings.

- As a single taxpayer, Amy must have checked Filing Status Box 1 and is subject to Rate “A” to calculate her withholdings. Because Amy is paid weekly, she must use the Weekly Payroll Period table.

According to Document NJ-WT, the employer must calculate her income tax withholdings using the following steps:

- Multiply the value of one allowance for the payroll period by the number of allowances claimed by the employer.

- Subtract the result from the employee’s wages to determine the amount of wages subject to withholding, then round to the nearest whole dollar.

- Refer to the New Jersey Withholding Tables to calculate the withholding amount.

In Amy’s case, if she claims two allowances, her employer must:

- Multiply the value of one weekly allowance ($19.20) by 2, obtaining $38.40.

- Subtract that number from Amy’s weekly wages to determine wages subject to withholding. In this case, it is $600 – $38.40, or $561.60. After rounding to the nearest whole dollar, the result is $562.

- Refer to the NJ Withholding Tables. In Amy’s case, she is paid weekly and her withholding rate is “A”. Her employer determines she falls in the second bracket: over $385 but not over $673.

- In this bracket, the amount of income tax to be withheld equals $5.77 + 2% of the excess over $385. Amy’s excess wage over $385 equals $562 – $385, or $177. In that case, the amount to withhold is $5.77 + 2% of $177, or $5.77 + $3.54.

- In total, Amy’s employer will withhold $9.31 for income taxes.

What Happens If My Employer Under-Withholds or Over-Withholds?

According to Document NJ-WT, your employer may have specific responsibilities if the amount they withhold is either too low (under-withholding) or too high (over-withholding).

- If your employer under-withholds for one pay period, they should inform you and withhold extra tax from subsequent payroll periods to make up the difference.

- If your employer over-withholds for a given pay period, the employer may offer you reimbursement of the difference. If you choose not to accept reimbursement, the law requires the employer to pay the full amount to the State of New Jersey in the quarter they withheld it. They must also enter the total amount on your Form W-2.

FAQs

Here are the answers to some common questions about filling out form NJ-W4.

Being exempt from Form W-4 does not automatically make you exempt from NJ-W4. In New Jersey, you will need to meet specific criteria established by the New Jersey Division of Taxation to claim exemption.

If you owe New Jersey taxes as a non-resident, fill the form out normally and include your out-of-state address in Line 1. If you are a resident of Pennsylvania, you might be exempt from New Jersey state withholding due to the state reciprocity agreement and must complete Form NJ-165 and submit it to your employer.

If your spouse or civil union partner is working as an active duty servicemember in New Jersey, you are not required to withhold income taxes in New Jersey from your paycheck. If this applies to you, you must submit a Form NJ-165, Certificate of Nonresidence, and a copy of your spousal military identification card to your employer with your NJ-W4.

No. Form NJ-W4 is a state-level employee withholding form for New Jersey. It is distinct from the federal IRS Form W-4.

If you claim zero allowances on your NJ-W4, your employer will calculate your tax withholding accordingly, resulting in less take-home pay.

There is no maximum number of allowances you can claim on a Form NJ-W4. However, if you claim too many allowances, your employer must inform you of it, and they may withhold additional taxes on subsequent paychecks to make up the difference.

If you do not complete and submit a NJ-W4 form, your employer will withhold state taxes as if you are single with no allowances.