Your tax preparation process is now easy and transparent, with simple pricing based on your situation. Here is how it works.

Use the following link to take a quick quiz about your tax situation and see personalized pricing generated immediately before ordering.

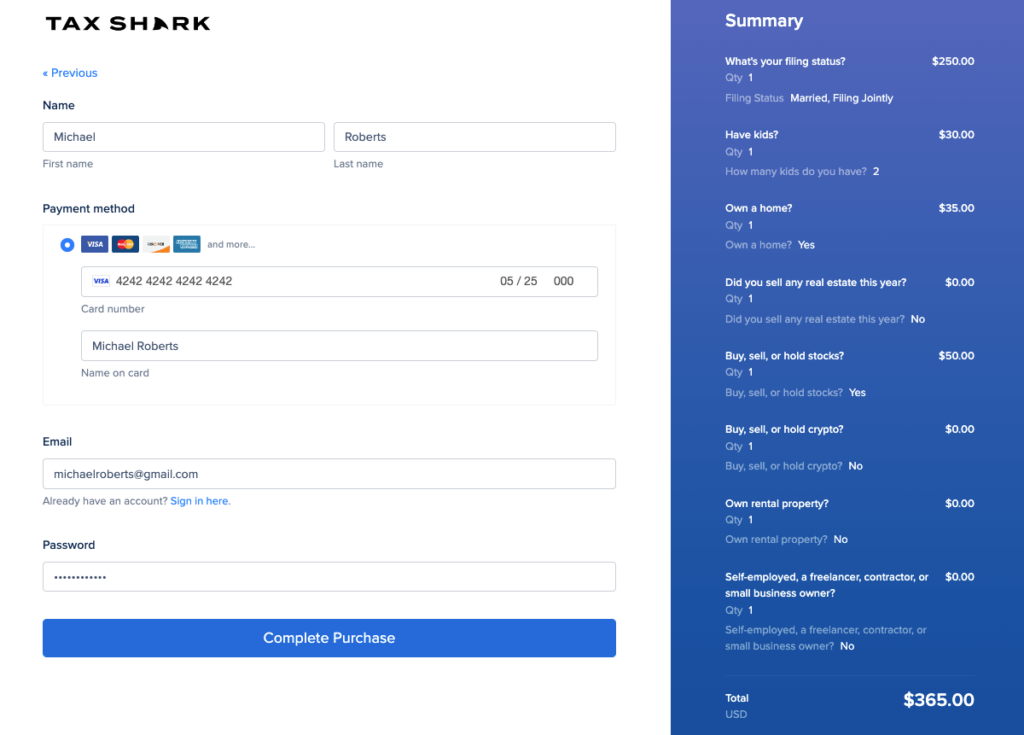

Once your quiz is completed, select “Complete Purchase”. We will receive a notification in our system to complete your tax return. There is no need to re-confirm.

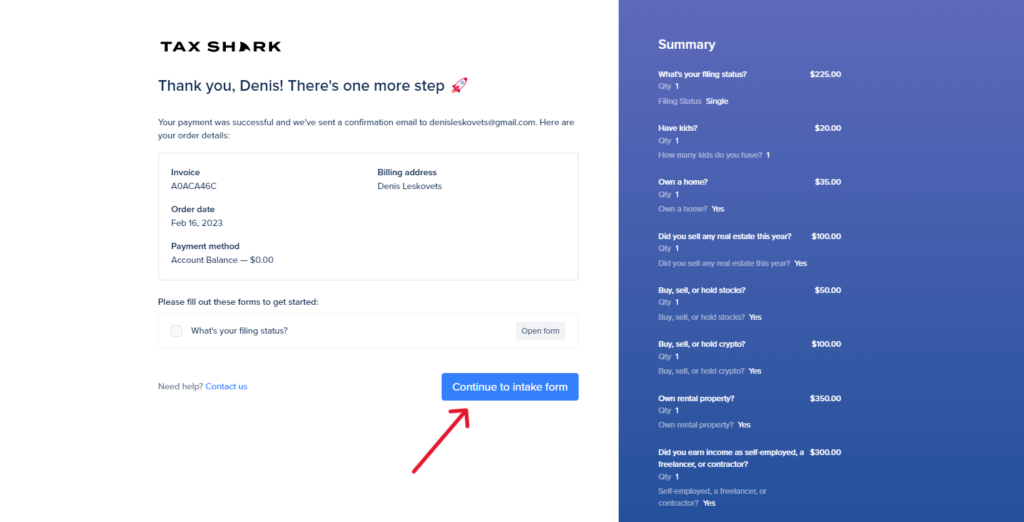

After purchase, select “Continue to intake form” to proceed.

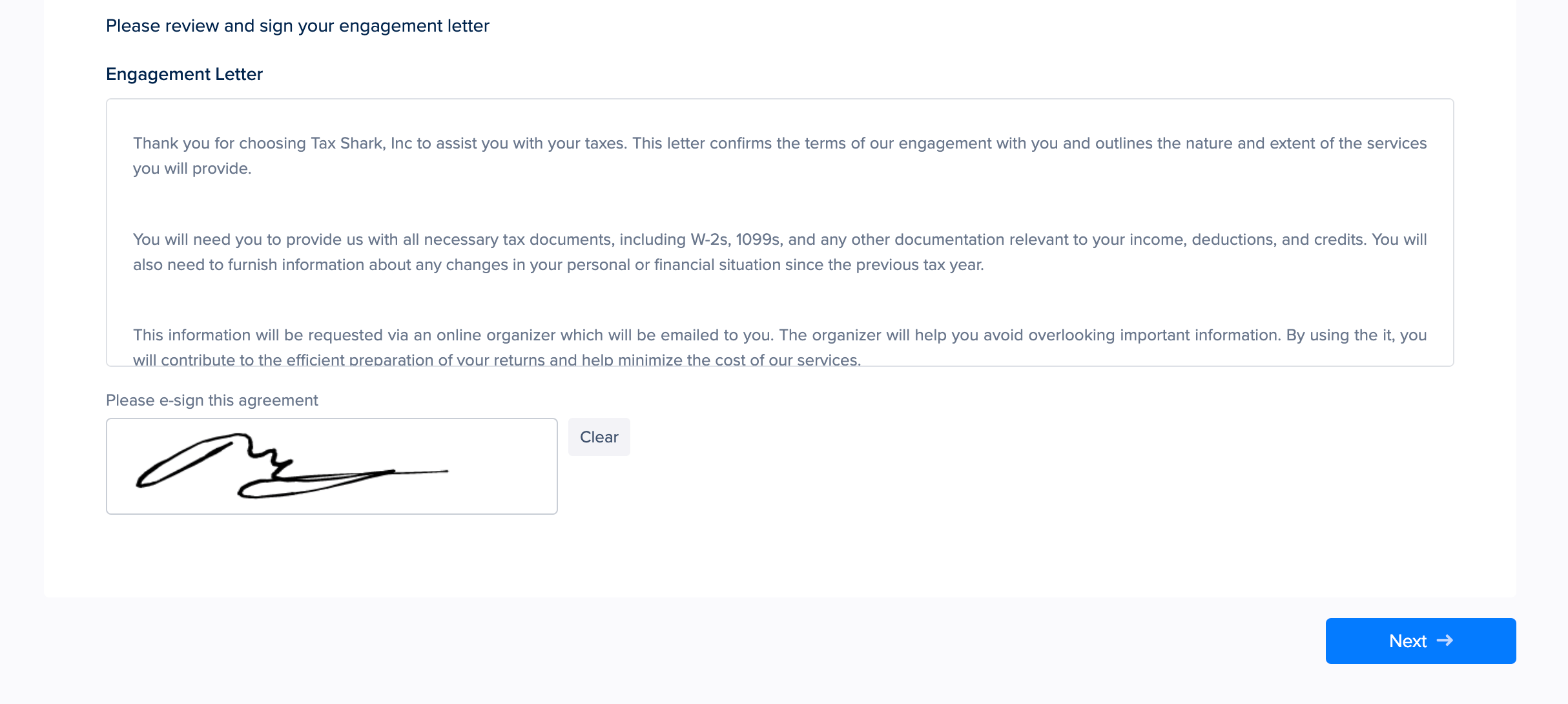

After processing payment, you will be automatically redirected to a portal where you will be asked to sign an engagement letter.

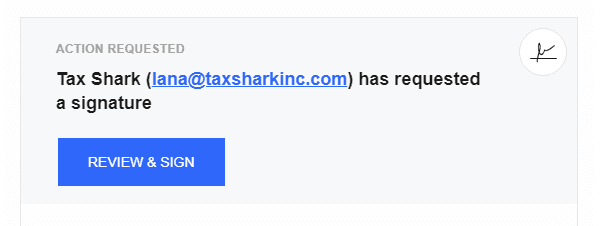

After signing, select “Next”.

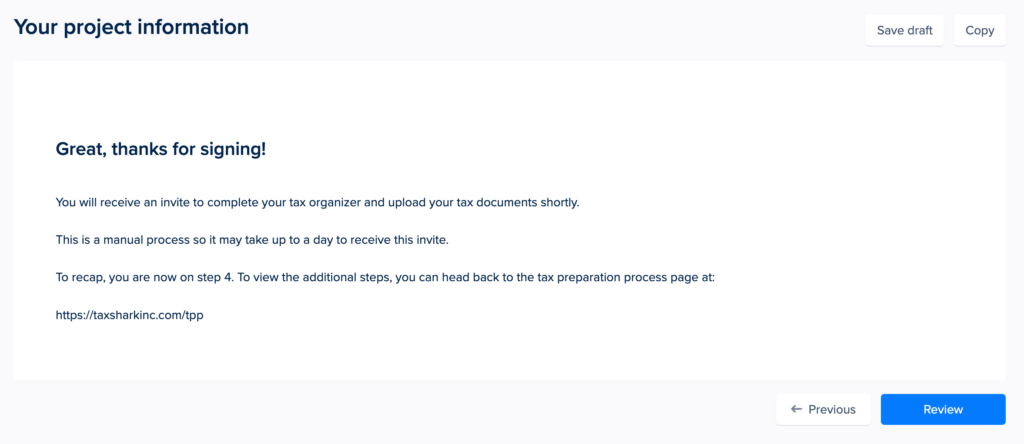

Press “Review” and submit your signature.

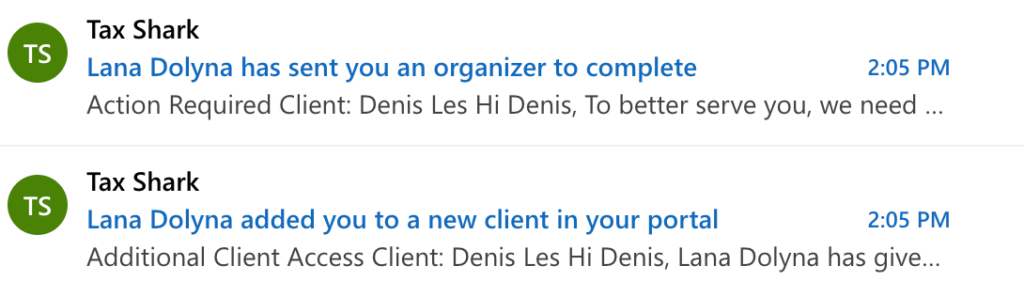

You will receive an email invite to complete your complete organizer and/or setup up your client portal shortly.

This is a manual process and may take up to a day.

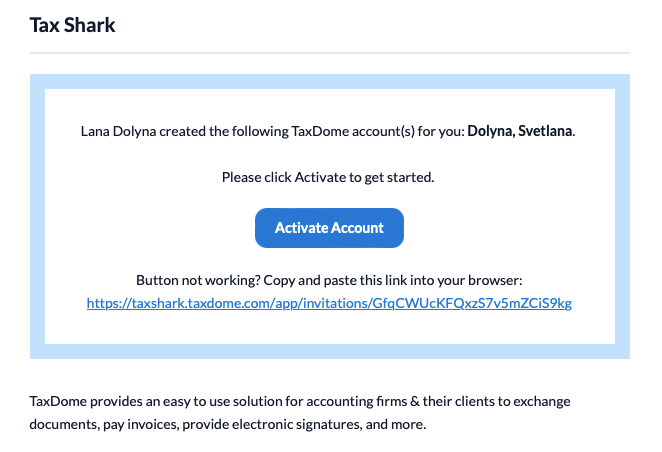

Open your email invite and select “Activate Account”.

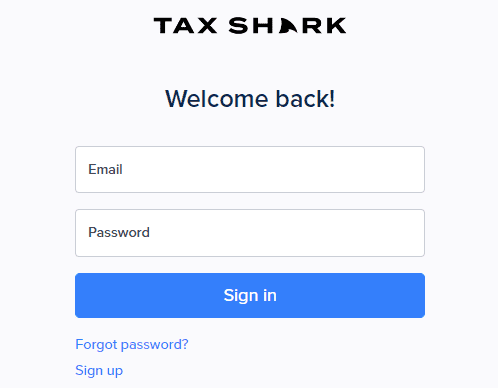

You will be taken to a page to set up your portal password.

If you have trouble logging in, click here, select the “Forgot your password?” button to reset your password.

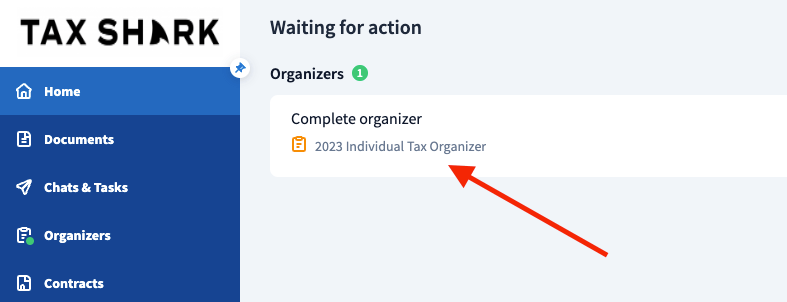

Start your organizer by selecting the complete organizer box.

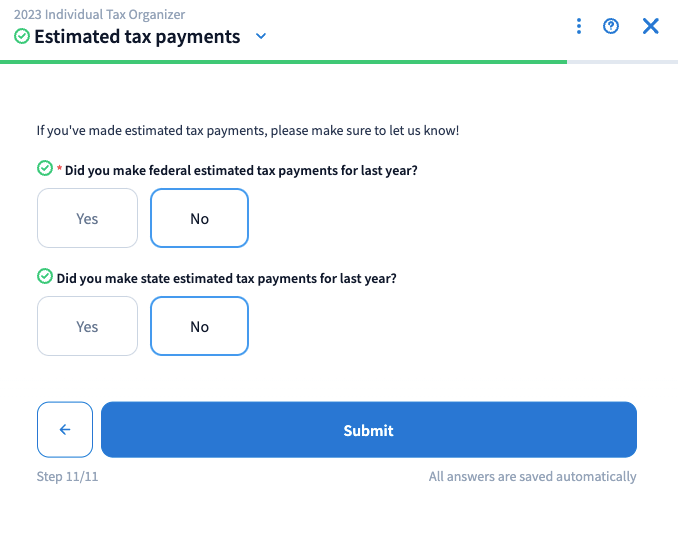

Throughout the organizer, you’ll will be asked to upload your tax documents.

Upload all that you can, even if some are missing. You can come back and add documents later.

Complete the organizer to the best of your knowledge and submit it.

Great, we received the information we need to prepare your return. If we need additional details, we’ll reach out.

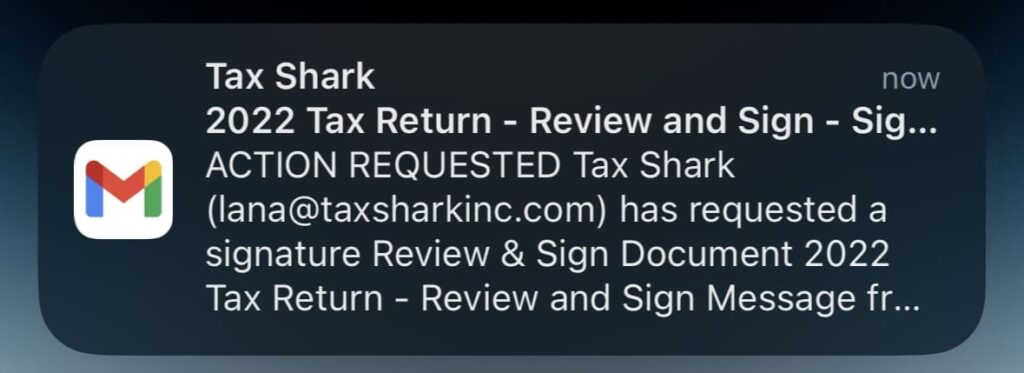

You’ll receive an email to review and sign your return after it’s been completed.

Please take your time to carefully review your tax return. Remember that you are signing under penalty of perjury.

You’ve made it! Once you sign your return we’ll e-file it with the IRS and the state.

If you have a question about your return, this is how you can get a hold of us.

Enter your login credentials and sign in. These are the same ones you used when placing for your order.

If you are unable to log in, select “Forgot password?” and reset your password.

Once inside the order portal, head over to the sidebar menu and select orders.

Select your order number

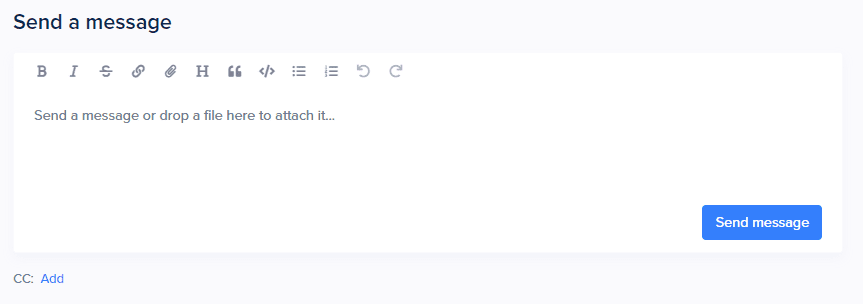

On the order page, scroll down a little and send us a message.

We’ll see your message and get back to you shortly!