Navigating tax codes can be a harrowing task, and even the IRS, the very entity that enforces tax laws in the United States, isn’t immune to making mistakes. Over the years, there have been some glaring missteps by the IRS that have left taxpayers scratching their heads. From computational errors to operational blunders, these incidents shed light on the complexities of managing a colossal tax system and the fallibility of even its stewards.

Some of these blunders have had significant repercussions, leading to public outcry and necessitating policy changes within the agency. These mistakes range from sending refunds to the wrong people to accidental disclosures of confidential information. Taxpayers are often reminded to double-check their own returns to avoid errors, yet these instances show that errors can happen on both ends of the spectrum.

$50,000,000 Data Breach

In 2015, cyber attackers pulled off a stunning heist at the IRS, cracking open the digital vaults to over 700,000 taxpayer accounts—a staggering number, far beyond initial estimates. Users’ Social Security numbers, birth dates, and other sensitive info fell into the wrong hands, potentially paving the way for false federal tax returns and fraudulent refunds.

The heist was methodical. Attackers, using previously obtained personal data, tricked the IRS’s “Get Transcript” feature by correctly answering security questions. This function, intended to help taxpayers access previous tax information, was promptly shut down after the breach was spotted. Initially, the IRS reported 100,000 breached accounts, bumping the figure to 334,000 later, and ultimately acknowledging the gravity with over 700,000 compromised accounts.

Initial IRS Estimate:

- Compromised Accounts: 100,000

Revised Estimates (1):

- Compromised Accounts: 334,000

Revised Estimates (2):

- Compromised Accounts: 700,000+

The audit trail later revealed even more attempted breaches against another half-million taxpayer accounts. The IRS responded by offering affected individuals free identity theft protection and specialized PINs to safeguard future tax filings, emphasizing its commitment to taxpayer security. In a series of computer snags faced by the IRS, this digital break-in ranks as a serious blunder, underlining systemic cybersecurity issues. With a history of warnings about its computer vulnerabilities, this wasn’t the first time the IRS’s technical defenses fell short, signaling an urgent need for overhaul.

$696,000 Purchase of Ammunition

The IRS, typically known for tax-related matters, made headlines with a hefty purchase of ammunition. An IRS spokesperson verified that the agency’s Criminal Investigation division spent $696,000 on ammo from March 1 to June 1, 2022. This move sparked questions and concerns, prompting Florida Rep. Matt Gaetz to propose the “Disarm the IRS Act” to prohibit further acquisitions of ammunition by the agency.

A comparison with historical spending reveals this isn’t a new expenditure trend for the agency. Between 2010 and 2017, the IRS’s annual average on ammunition was $675,000. The peak of this spending occurred in 2011, with the IRS spending $1.1 million.

In contrast, other federal agencies have their own spending patterns for ammunition. For instance, the Treasury Inspector General for Tax Administration averaged about $250,625 annually on ammunition, whereas the U.S. Marshals Service tallied nearly $3.2 million yearly on average during the same period.

The purchase is intended for the IRS-CI division, a team with over 2,000 special agents who deal with severe offenses like money laundering and organized crime. The IRS emphasizes that their agents often work alongside other law enforcement agencies and occasionally encounter highly dangerous criminals. Carrying firearms and ammunition is a longstanding practice within IRS-CI, tracing back over a century.

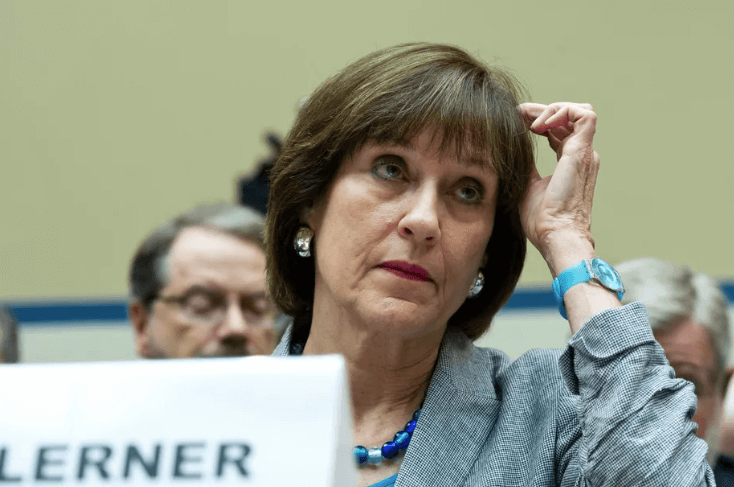

2013 Political Profiling Scandal

In 2013, an unexpected revelation shook the IRS: agencies were found to have placed undue scrutiny on particular political factions, notably conservative groups. This discovery garnered nationwide attention due to the implications of bias within a federal agency.

Findings & Investigations: The Treasury Inspector General for Tax Administration unearthed practices where the IRS delayed certain conservative groups’ tax-exempt status applications. Additionally, they solicited information that was later considered extraneous. The Justice Department launched a probe into missing emails which deepened the controversy. However, in October 2015, the investigation concluded without any criminal charges filed.

The Crux of the Matter: Groups faced additional screening if their name contained terms like “Tea Party” or “patriot”. A pivotal report highlighted the IRS had employed “Be On the Look Out” (BOLO) lists to flag groups for more intensive review based on their affiliations rather than potential political campaign intervention signs.

Leadership Under Fire: The scandal prompted IRS Commissioner Steven Miller to resign. Lois Lerner, the official at the heart of the controversy, retired after her involvement came to light. She had previously pleaded the Fifth Amendment when called to testify about the agency’s actions.

Aftermath: By mid-2013, the agency stopped the use of BOLO lists. In 2015, the IRS stared down an exhaustive Senate Finance Committee investigation which pegged the scrutiny as a result of organizational mismanagement. While the Justice Department’s closure of its investigation with no charges might have curbed legal repercussions, the incident left a lasting impact on the IRS’s image.

The IRS Master File is 60 Years Old

The Internal Revenue Service operates on surprisingly ancient software, tracing back to the era when bell bottoms were all the rage and eight-track players were the cutting-edge tech. Central to this digital antiquity is the IRS’s Individual Master File system, a relic that has been chugging away faithfully since 1970.

Built on the programming languages COBOL and Assembly—which for the tech crowd might evoke a mix of nostalgia and horror—the system has seen little modernization. COBOL, a language older than many of the IRS’s own employees, remains a critical part of handling Americans’ tax data.

Year Established | Technology Age |

1970 | 60+ years |

GAO’s recent review emphasizes the gravity of the situation: out-of-date applications, hardware lagging behind by several generations, and bloated operational costs due to inefficiencies. These shortcomings manifest not just in technical debt but also in real-world consequences: delays in processing and increased security risks. For taxpayers, this means anxiety-inducing waits for updates about refunds and a cumbersome process to ensure their information is secure.

The plan is to move away from the Master File by 2030, yet skepticism abounds on meeting this goal. The IRS’s hesitance to set a newer, realistic upgrade timeline only feeds into concerns. Meanwhile, funding to the tune of $80 billion has been earmarked for enhancing IRS operations, with a substantial slice for IT enhancements and staffing. Whether these funds will be directed effectively and expediently remains a topic of hot debate.

‘Tis the season of tax filings, and the agency is already facing dilemmas with state inflation relief payments and their tax implications—indicative of the wider systemic issues at play. It’s high time for the IRS to join the modern world, for the sake of both the institution’s efficiency and the public’s trust in it.

1 Trillion in Taxes is Unpaid Every Year

The Internal Revenue Service (IRS) faces a staggering challenge: roughly $1 trillion in federal taxes goes unpaid each year. This gap, termed the “tax gap,” represents unpaid obligations by certain taxpayers who evade tax laws. Tax noncompliance is a significant contributor to this predicament.

Here’s a breakdown of the unpaid taxes:

- Non-filing: Some taxpayers simply do not file their tax returns.

- Underreporting: Others may file but underreport their income.

- Underpayment: Then, there are those who report accurately but fail to pay the full amount they owe.

Efforts to collect these taxes are constrained by several factors:

- Limited resources: The IRS operates with finite resources, hindering its ability to pursue all cases of tax evasion.

- Complexity of the tax code: The intricate U.S. tax code allows savvy taxpayers to find loopholes.

- Enforcement challenges: Auditing the right returns and battling sophisticated tax avoidance require advanced strategies.

The IRS estimates that a significant portion of the gap stems from understated business income, non-filing, and underreported individual income, particularly among those who work for themselves. By enhancing enforcement and streamlining the tax filing process, the IRS aims to reduce this deficit and ensure a fairer tax system.