Claiming dependents when filling out the IRS Form W-4 has a significant impact on your end-of-year tax liability and take-home pay. The more dependents you claim, the less income your employer withholds for taxes, leaving you with more money in your pocket.

Unfortunately, simply counting your family members is not the correct way to claim qualified dependents on your W-4 form.

Learn who qualifies as a dependent, rules for claiming a dependent, how to claim your dependents, and common mistakes when claiming dependents on Form W-4.

Following this guide will ensure you correctly claim your children and qualifying dependents and protect yourself from lowering your paycheck.

- Tip

Only one spouse is allowed to claim dependents. Typically, it’s the higher earner.

Who Qualifies as a Dependent for W-4 Purposes

According to the IRS, a dependent is a qualifying child or a qualifying relative of the taxpayer. Having a dependent entitles the taxpayer to claim a dependency exemption on Step 3 of the W-4 form. A dependent cannot be the taxpayer or the spouse, but can be children and other individuals for whom you provide financial support and that meet IRS requirements.

Qualifying Child as a Dependent for W-4

To claim a child as a dependent on the child must be younger than you, younger than 17 years old or be a student younger than 24 years old as of the end of the year.

To meet the definition of a qualifying child, the dependent must meet the following criteria:

- Be related to the taxpayer in one of the following ways:

- The taxpayer’s child, biological, stepchild, foster child (if placed by an authorized agency), or a descendant of any of these, such as a granddaughter.

- A sibling of the taxpayer, including half-siblings and step-siblings, or any of their descendants.

- Meet one of the following age and disability criteria:

- Younger than the taxpayer and either under the age of 19 at the end of the tax year

- If the child is a full-time student, they must be under the age of 24 at the end of the year

- No age criteria is needed if the child is permanently and totally disabled

- Have lived with the taxpayer for more than half the tax year at their home, defined as “any location where they regularly live,” even if it isn’t a traditional home.

Qualifying Relative as a Dependent for W-4

To claim a relative as a dependent the relative can be of any age, earn less than $4,400, must not be a qualifying child of the taxpayer or anyone else, be related to the taxpayer as a child, sibling, parent, grandparent, niece or nephew, aunt or uncle, certain in-law, step-relative, OR live in the taxpayer’s household during the entire tax year.

To meet the definition of a qualifying relative, the dependent must:

- Not also be a qualifying child

- Be a member of the household for the entire tax year

- Meet one of the following definitions of “relative:”

- Child, stepchild, foster child, or a descendant of any of them not meeting the definition of a qualifying child

- Sibling, half-sibling, or step-sibling

- Parent, grandparent, and other direct ancestors (foster parents do not qualify)

- Step-parent

- Child of the taxpayer’s siblings or half-siblings, such as a nephew or niece

- Sibling of the taxpayer’s parents, such as an uncle or an aunt

- Relatives-in-law: children, parents, siblings

- Have a gross income under $4,400, as defined by federal law. The threshold amount for the tax year, as of January 2023, via the latest revision of IRS Publication 501 puts the threshold at $4,400 or more.

- Pass the IRS’s “support test,” which requires the taxpayer to have provided more than 50% of the total amount spent to support the dependent’s needs. The IRS provides a worksheet to help determine whether a taxpayer has provided a person enough financial support to claim them as a dependent.

Examples of Qualifying Dependents

Below are a few common examples of individuals who meet the definition of a qualifying dependent, allowing a taxpayer to claim them for W-4 purposes:

- A son aged 14

- A daughter aged 22 who is currently enrolled as a full-time student in university

- A son aged 27 who has paralysis caused by a spinal cord injury, meeting the definition of permanent and total disability

- A retired grandmother living permanently in the taxpayer’s home and receiving $3,000 of total earned income

Rules for Claiming a Dependent on a W-4

To claim a child or other qualifying dependent on a Form W-4, the qualifying dependent can have income but cannot provide more than half of their own annual support, must meet all definitions of a qualifying dependent, and must uphold the following rules:

- You cannot claim dependents if your yearly income exceeds the limit corresponding to your status:

- If single or married person filing separately: $200,000

- If married and filing a joint return: $400,000

- You cannot claim dependents if you (or your spouse if filing a joint tax return) can be claimed as a dependent by another taxpayer.

- You cannot claim your married spouse as a dependent.

- Exception: When filing tax returns jointly and only when claiming a refund of withheld income tax or estimated tax paid.

- You cannot claim any individual as a dependent if they are not a U.S. citizen, resident alien, national, or a resident of Canada or Mexico.

- Exception: If the dependent is an adopted child that doesn’t meet the definitions above, you may still be able to claim them as a dependent if they live with you as a household member for an entire tax year.

How to Claim Dependents on a Form W-4

To claim dependents on a W-4 your total income should be $200,000 or less if filing as an individual – or $400,000 or less if married and filing jointly. If your income is higher, you can’t claim dependents and will skip step 3.

If you are under the income limit you may claim dependents on a Form W-4 by filling out the appropriate fields in Step 3.

There are four required steps to claiming dependents:

Step 1: Determine Your Status and Yearly Income

- First, verify your marital status, filing status, and yearly income.

- If you make $200,000 a year or less, or $400,000 if you are married and filing jointly, you may claim dependents on a W-4. Otherwise, leave all fields in Step 3 blank.

Step 2: Count The Number of Qualifying Dependents

- Form W-4 Step 3 distinguishes two types of qualifying dependents: qualifying children under 17 and other dependents.

- If you have qualifying children aged 17 or older, they count as “other dependents.”

- Any qualifying relative not meeting the definition of a qualifying child also counts under “other dependents.”

Step 3: Check Whether You Have Qualifying Credits

- Form W-4 Step 3 allows you to add the amounts corresponding to additional earned income tax credits to your claims, such as education or foreign tax credits.

Step 4: Calculate The Amounts and Fill Out the Form

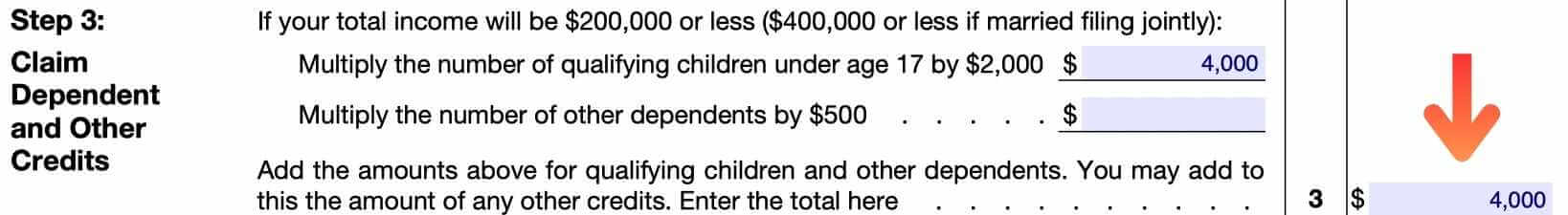

To claim dependents on Form W-4, multiply the number of qualifying children under 17 by $2,000 and multiply the number of other dependents by $500. Take the total dollar amount and enter it on Step 3 of Form W-4.

Example: If you have 2 qualifying children, multiply 2 by $2,000, totaling $4,000. Put $4,000 in Step 3. You’ve now claimed your dependents.

- In the first field, multiply the number of qualifying children aged under 17 by $2,000.

- In the second field, multiply the number of other qualifying dependents by $500.

- In the third field, enter the total amount equal to the amounts you entered in the first two fields, plus the amount of any qualifying credits.

Example

- Suppose you have five dependents: three children under the age of 17, a daughter aged 22 currently enrolled as a full-time student, and a disabled grandmother receiving less than $4,400 a year in gross income and whom you provide 100% support. You do not have any additional credits.

- In the first field of Form W-4 Step 3, you’ll enter $6,000: 3 qualifying children aged under 17 x $2,000.

- In the second field, you’ll need to enter $1,000: 2 qualifying “other dependents” x $500.

- In the third field, enter $7,000: $6,000 from the first field + $1,000 from the second field + $0 in additional credits.

Tips for Accurately Completing the Dependent Section of a W-4 Form

- Use the IRS W-4 withholding calculator to estimate how much your employer will withhold. Do not use the calculator if your tax return includes long-term capital gains, qualified dividends, or you are self-employed.

- Claiming too many dependents when your income is above $100,000 may lead to under-withholding and a underpayment penalty from the IRS.

- Unlike other IRS forms, such as the W-9, Form W-4 requires you to include your Social Security Number (SSN). You cannot use another Taxpayer Identification Number, such as your Employer Identification Number (EIN) or your Individual Taxpayer Identification Number (ITIN).

- When determining your yearly income for dependent claim calculations, use the marital and filing status you provided in Step 1(c) of the form.

- You do not have to claim as many dependents as you indicated in your tax returns. While it is generally acceptable to claim fewer than you are entitled to, it will result in less take-home pay and a higher amount withheld for federal income taxes. However, it is critical to avoid claiming more than you have to avoid a tax audit.

- If your family situation is complex and you need clarification on what counts as a qualifying dependent, ask a tax expert for help.

The Impact of Claiming W-4 Dependents on Your Tax Liability

Claiming dependents on form W-4 will lower your tax liability and increase your take-home pay. Not claiming dependents on form W-4 will result in more taxable income being withheld from your paycheck and lower your take-home pay.

How Claiming Dependents Affects Your Tax Bracket and Rate

Having dependents may lower your taxable income enough to push you into a lower tax bracket.

Example: If you make $42,000 a year and claim one child on your W-4, your taxable income will be reduced to $40,000, changing your tax bracket from 22% to 12%.

The Potential Impact of Claiming Dependents on Your Tax Bill and Refund

Claiming dependents lowers your tax liability and the amount you pay in taxes. Since you are paying less in taxes, you will have a smaller tax refund.

Example: If you claim two children on your W-4, you will reduce your total taxable income by $4,000. By deducting that amount from your taxable income, you will no longer be taxed on it, and it will be ineligible for a refund.

Common Mistakes to Avoid When Claiming Dependents on a W-4 Form

Ensure you accurately document the number of dependents you have and account for their deductions. Misrepresenting this number can have severe consequences.

The Consequences of Claiming an Ineligible Dependent

Knowingly claiming a false dependent is considered tax evasion and a felony. Doing so without intent will result in you being required to pay the full amount and a late fee.

Example: You accidentally claim an extra child on your W-4, resulting in $2,000 less of taxed income in your 22% tax bracket. This results in you owing $442.20 on the $2,000 (22% of $2,000 is $440, plus a late fee of 0.5% per month, which is $2.20 for one month).

The Importance of Accurately Estimating the Number of Dependents You Are Entitled to Claim

By accurately estimating your number of dependents, you will pay the proper amount the first time and avoid any late fees or later payments to the IRS. If you put too few dependents, you will pay more in taxes than you owe, but if you put too many, you risk being penalized with a late fee or a tax audit.

Example: You accidentally leave off a child from your W-4 form and claim only $2,000 for one child instead of $4,000 for two children. At your 22% tax bracket, you are taxed on the $2,000 you did not claim as a deduction and pay an additional $440 in taxes.

Yearly Dependent Checkup for Your W-4

You should review and update your W-4 form annually around tax time or around common lifestyle changes like getting a job or getting married. This will ensure that the correct taxes are withheld from your paycheck.

You can make changes to your W-4 form by submitting a new W-4 to your employer. It’s crucial to ensure that you have the right amount of taxes withheld, so you don’t owe a large amount at the end of the year or get a smaller refund than expected.

FAQs

Here are the answers to some common questions about claiming children and dependents on form W-4.

You cannot claim your spouse as a dependent, but you may claim your spouse as an exemption under certain conditions.

Claiming dependents will give you more money per paycheck because you have less tax withheld.

No, a dependent is a tax reduction, whereas an allowance is reduced withholdings.

Multiply your number of children under age 17 by $2,000 and any other dependents by $500. Record the result on Line 3. If you have no dependents, put $0 on all lines.

Yes, depending on other factors. A child under 24 who is a full-time student may be claimed as a dependent.

To get the maximum refund on a W-4, you should ask for more money to be withheld in step 4(c).

Yes, the IRS may ask for proof of relationship through marriage or birth certificate.

No, you do not have to claim all of your dependents on a W-4.

Yes, you can claim your parents as dependents on a W-4, as long as they have not earned or received more than the gross income test limit for the tax year you are claiming.