Whether you agree with the IRS’ corrections or not, you need to respond to a CP2000 notice in a timely manner as there are consequences for not responding on time.

Table of Contents

Your CP2000 Response Options Are…

Since you need to respond to the CP2000 notice as soon as possible, you need to select one of the options on the notice then take the following actions. Your notice may also have a response form enclosed. If not, there will be instructions on the actual letter.

Depending on how the changes made differ from the amounts the IRS has on file, they may result in an increase or decrease to your tax liability for the year, or no changes at all.

I agree with my tax assessment.

If you agree with the IRS’ findings, you need to sign the enclosed response form with your notice. If you are married filing a joint return, both you and your spouse will need to sign it (if one was included with your notice).

If the corrections made to your tax return result in a balance due and you are able to pay it right away, you can pay online through the IRS website.

However, if you are in doubt of the assessment, you should consult with Tax Shark to determine if the IRS made a mistake or you did.

I agree with my tax assessment but cannot pay.

If you agree with the IRS’ findings but the changes resulted in a balance due that you are unable to pay, you should indicate such on the response form (if one was included with the notice).

If you do not have a response form, you should request an installment agreement with the IRS Online Payment Agreement tool if you anticipate that you will need more than 120 days to pay your balance. If you are experiencing more extreme financial hardship, you may also be able to go into Currently Not Collectible status to prevent further collection action while you figure out your payment options.

I do not agree with my tax assessment and cannot pay.

If you do not agree with the IRS’ findings and also cannot pay the additional taxes the agency claims are due, you should fill out the response form if one was included.

Regardless of whether one was or not, you should provide a statement explaining why you disagree along with supporting documents that back up your claim. If the IRS claims that the information you supplied was incorrect, you should contact the entity that furnished it. They should provide a corrected version or statement that explains the errors, which needs to be included with your response to the IRS.

Since you are disputing whether you owe additional taxes, you do not need to take action on collection issues yet like requesting an installment agreement or Currently Not Collectible status.

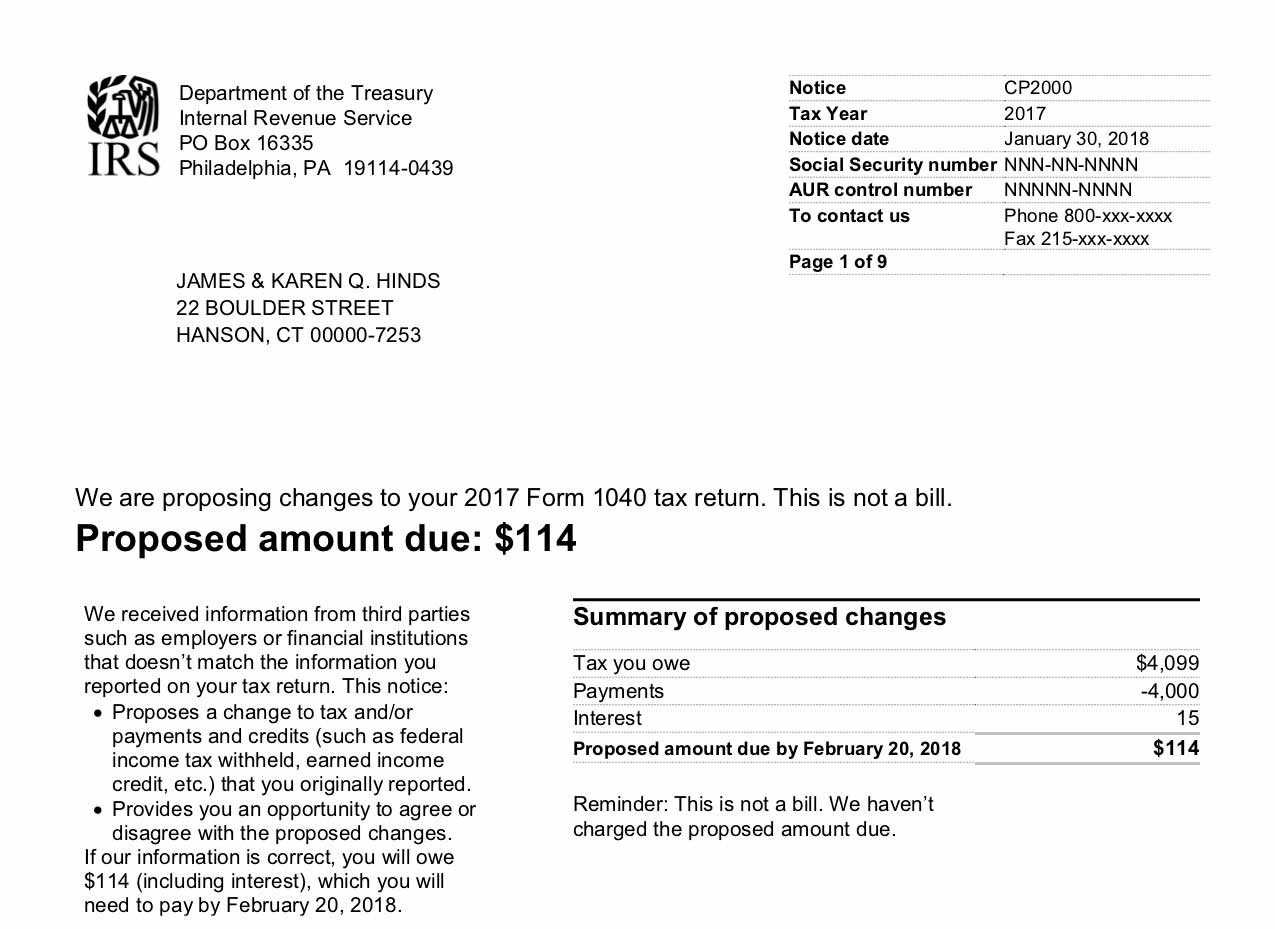

What is an IRS CP2000 notice?

The IRS issues a CP2000 notice if there is a mismatch between your tax return and the information that the agency has on file. If you received a CP2000 notice, it is likely because:

- The income reported on your tax return doesn’t match with the income records the IRS has

- There are other discrepancies on your tax return that the IRS corrected with information on file

- You owe additional taxes because of the changes made to your tax return pursuant to the CP2000 notice

Approximately 3.7 million CP2000 notices are issued every year as part of the IRS’ automated process server. However, it’s important to remember that CP2000 notices are not always accurate.

While it’s possible you may have made mistakes on your tax return, or the firm responsible for filing your W-2 and 1099 tax forms also made mistakes, sometimes CP2000 notices are issued in error. If you were due a corrected form and already filed an amended return, the CP2000 notice could still be generated regardless.

Whether you agree with the IRS’ corrections or not, you need to respond to a CP2000 notice in a timely manner as there are consequences for not responding on time.

Stop the Proposed Changes from Becoming Actual Changes

If you are disputing the proposed changes on your CP2000 notice, and it resulted in an increase to your tax liability, you need to confirm your tax liability by ensuring that the proposed changes don’t turn into actual changes.

In addition to contacting issuers like employers, brokers, and other issuers of information, you should also contact the IRS to request wage and income transcripts for the tax years in question on your CP2000 notice. Review your tax return and the information reported on these transcripts to determine if there are any discrepancies.

Respond to the IRS

The IRS often makes mistakes when issuing CP2000 notices. Transcripts may be inaccurate, corrected versions of forms not submitted by the issuer in a timely manner, and glitches are all plausible reasons why you were sent a CP2000 notice if there were no errors or omissions on your part.

When responding to your CP2000 notice, put a package together with all of your evidence that substantiates your disagreement with their proposed changes. If the numbers on your wage and tax transcripts and tax forms do not line up with the proposed changes on your CP2000 notice, then they should not be made into actual changes. If you are correct, the proposed changes will be dropped.

However, if the IRS winds up being correct and mistakes were made on your tax return due to information mismatch, you should request an installment agreement or apply for an offer in compromise as soon as possible if you cannot pay the taxes due. You should also respond as soon as possible because the longer you wait to respond, the more interest and penalties that will accrue on your balance.

In the best-case scenario, the CP2000 notice was issued by mistake and no changes are made to your tax return. In order to find out, you still need to respond to the IRS as soon as you can.

FAQs

What is the phone number for the IRS CP2000 department?

The phone number will vary depending on your state of residence. The appropriate IRS campus for your region will have their phone number and operating hours listed on your notice.

Can you receive a time extension to respond to a CP2000 notice?

Yes, the IRS will grant you a one-time 30-day extension if you call the phone number on your CP2000 notice and make an extension request.

Where do you send the IRS CP2000 response?

Similar to the phone number you need to call, the mailing address will vary based on your state of residence. Your CP2000 notice will have the appropriate mailing address for your region on your notice.

How can I get CP2000 notice help?

Tax Shark’s tax resolution experts can assist you with surprise CP2000 notices. Contact us and we can help.

Can you pay a CP2000 tax liability using a credit card?

Yes, the IRS accepts credit card payments from three approved vendors listed on the IRS website. If you owe more than $100,000 in taxes and wish to pay with a credit card, you will need to contact one of the vendors by phone to arrange this.

How to Get Expert CP2000 Help

If you are unsure how to respond to a CP2000 notice and ascertain if your records are correct, Tax Shark’s experienced tax resolution professionals can contact the IRS for you and help you get the best outcome for your situation. In addition, Tax Shark resolves other IRS notices like the CP49.